Written By:

Erin Moore | Sr. Salesforce Consultant

Salesforce Financial Services Cloud (FSC) is a specialized version of Salesforce CRM, a part of the Salesforce Industries offerings, with features and functionalities for three verticals in the financial services industry; Insurance, Banking, and Wealth Management. Salesforce licenses for these different verticals of the financial industry are available through different licenses of FSC: FSC Sales, FSC Service and FSC Sales & Service.

This article will focus on Wealth Management available with the FSC Sales License.

Salesforce FSC provides a digital transformation and improves wealth management outcomes by consolidating data from siloed systems, reducing the amount of time financial advisors spend switching between systems, and allowing advisors to manage assets, customer relationships, and customer experience within a rich context of associated businesses and legal entities, personal relationships, life events, and goals.

Financial planning and advice tools support the process, allowing for personalized financial plans to be produced directly out of Salesforce. Compliance and security features ensure compliance with regulatory requirements, while integration capabilities allow for streamlined processes and data access across various platforms.

Salesforce Financial Services Cloud Features

Financial Accounts and Integrations

Salesforce Financial Services Cloud (FSC) provides a native Financial Account object with pre-defined record types for various financial accounts, such as investment, insurance policies, bank deposit, and loan accounts. Sophisticated Integration Definition tools can streamline securely connecting external accounts, bring in transaction records related to them, or bring in third-party investment system data. Client asset management information can be viewed for each member of a household or rolled up to the member’s household record for an aggregate view of a household’s holdings as well as other assets and liabilities.

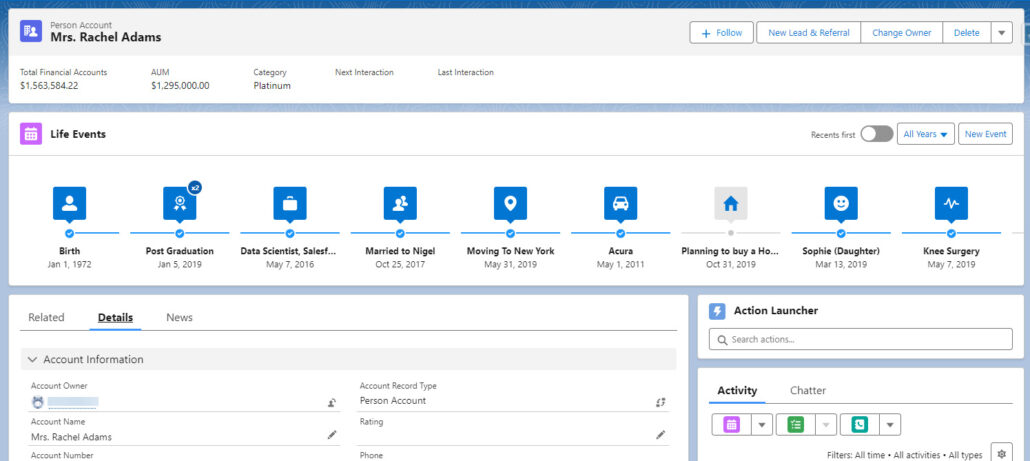

Goals and Life Events

Financial Goals can be associated with an individual or a household and used to track clients’ financial goals. FSC allows employees to view how priorities evolve over the course of their client relationships. Life events and milestones like births, college entrance dates and retirement targets can be tracked in a timeline also.

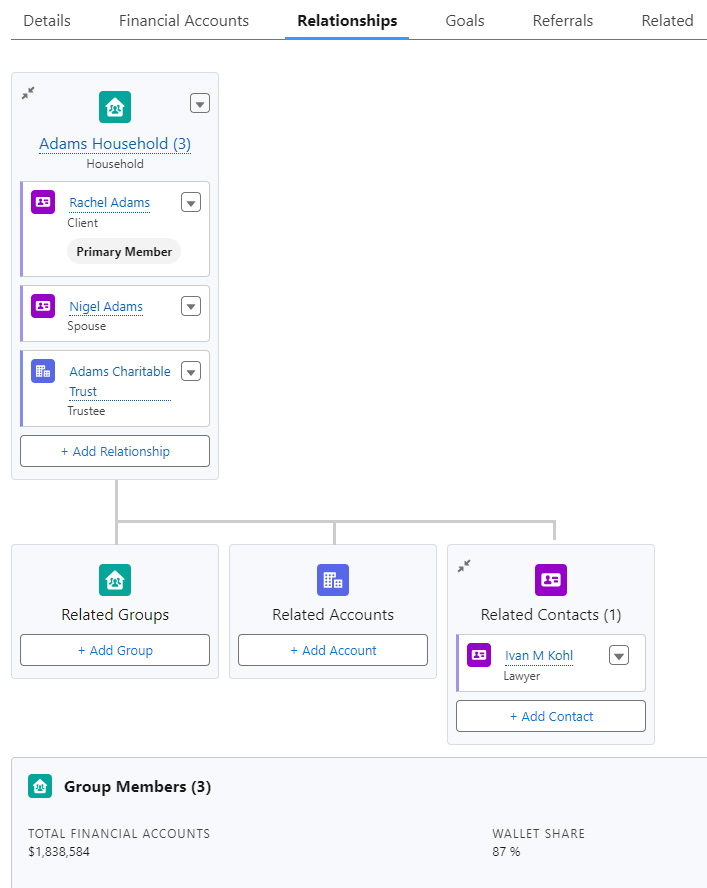

Relationship Management

Relationship Maps provide a clear understanding of a client and their household’s personal and professional relationships, including businesses and legal entities such as a trust. View summary information on the tiles showing aggregate holding summaries. Use the map to create and manage relationships and take some actions. The Actionable Relationship Center (ARC) in FSC Sales edition is more flexible and allows far more actions to be launched from its interface.

Referrals

FSC provides enhanced referral tracking making it easy to capture referrals from team members or clients through the lifecycle by using referral path settings. This functionality has automation built in that allows the assignment of referrals to the agents or queues related to specific products. This feature allows you to identify the most valuable people referring you to new potential clients through a dashboard widget that shows your top referrers.

Onboarding

Financial Services Cloud in Sales, Service, and Sales-Service Editions has a built-in KYC data model and Discovery Framework tools to simplify onboarding new clients with full compliance to the Know Your Customer regulations. We dive deeper into this feature below in the regulatory compliance section.

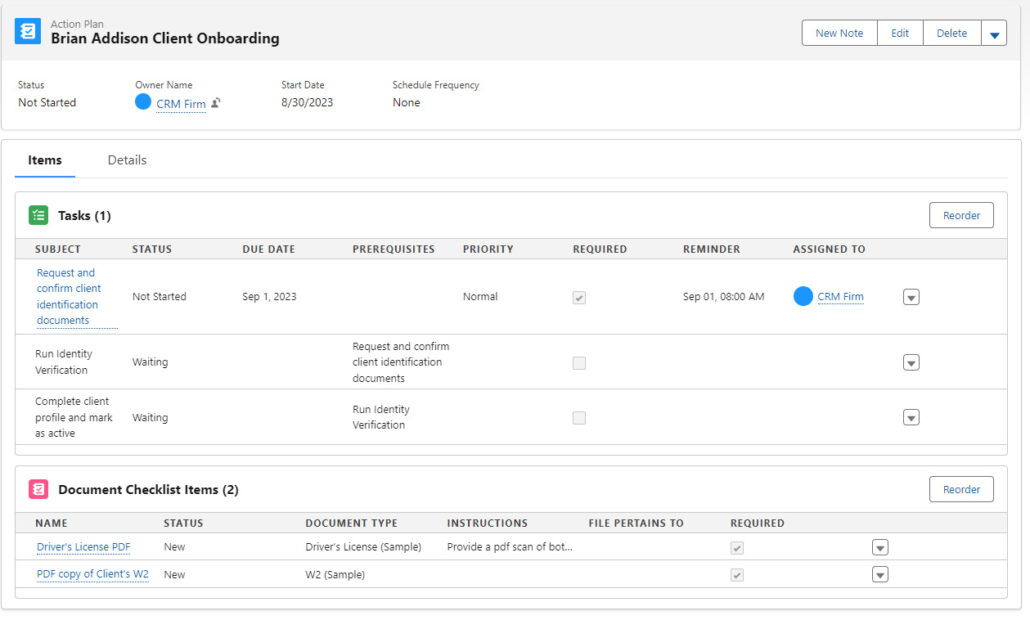

Action Plans

Financial Services Cloud Action Plans enable employees to deliver consistent and compliant client engagement experiences by creating repeatable collections of tasks and associated document checklists and automating the assignment and tracking of these workflows. FSC also provides enhanced Intelligent Document management, including OCR reading of forms and robust document ingestion and approval workflows.

Reporting and Analytics

Advisors can keep track of their book of business through excellent dashboards and reports. If you purchase the add-on license for Financial Services Cloud Intelligence you will have access to CRM Analytics dashboards, reporting and analysis tools tailored for financial services companies.

More Tools

Looking for more features? We haven’t yet covered the full feature set of Financial Services Cloud, just some of the more commonly used features for Wealth Management firms, focused mostly on the Sales Edition.

Financial Services Cloud has both complete feature sets from Sales Cloud underlying. Plus, it has many additional tools and features from the Salesforce Industries platform that add user interface, automation, data management, and data integration capabilities to the standard Salesforce toolset, greatly enhancing options for customizing and improving processes.

Regulatory Compliance

Know Your Client (KYC)

Know Your Client (KYC) is a standard in the investment industry that ensures advisors verify a client’s identity and investment knowledge. It consists of three components: the customer identification program (CIP), customer due diligence (CDD), and ongoing monitoring or enhanced due diligence (EDD).

The SEC mandates that new customers provide detailed financial information before opening an account. KYC is an ethical requirement for securities industry professionals dealing with customers, establishing their personal profile before financial recommendations.

Financial Services Cloud in Sales, Services, and Sales & Service Editions has a built-in KYC data model and Discovery Framework tools to simplify onboarding new clients with full compliance and can tie into third party provider tools for enhanced identity verification using the Data Consumption Framework.

PII Regulations

Wealth management firms must protect Personally Identifiable Information, or PII, to prevent cyberattacks and maintain a strong reputation. This includes sensitive information like name, address, marital status, financial status, login information, and email address.

FSC Sales Edition Compliance tools

Adherence to data privacy laws and regulations for wealth management firms is crucial, including potentially the Gramm-Leach-Bliley Act, SEC Safeguards Rule, and FTC Safeguards Rule.

These laws require advisory firms to provide transparency about their privacy policies, prohibit nonpublic personal information disclosure, adopt policies and procedures for safeguarding customer information, maintain a log of authorized users and have clear off-boarding procedures to remove former contractors from accessing client PII after exit.

The FSC Sales Edition tools and Salesforce’s built in security and access controls go a long way in controlling access generally, and Salesforce Shield can be added for data encryption if needed. The FSC Sales Edition also provides enhanced capabilities targeted at compliance for financial services.

Compliant Data Sharing can be configured with advanced data sharing rules and the following tools have role-based sharing and clear identification of all individuals with access to client data.

Financial Deal Management allows control of all aspects of information related to a deal, including role-based data sharing for parties involved.

Intelligent Document Automation is used for automating Consent and Disclosure forms created and managed on platform and using role-based sharing.

You can find a full list of all the features available in each edition through this link.

FSC Implementation Options

FSC is a financial services platform that can be used in various ways to meet the needs of different clients in the Financial Services Sector. There are a few different implementation approaches that can be used. A firm which is already on the Salesforce platform will need to undergo an assessment to determine if they need to migrate to a new Org or if they can upgrade in place. The three basic approaches in either case is the following.

Moderate Customization

Using the product fully as designed in FSC Sales Edition is best for wealth management firms like Registered Investment Advisors. This Edition also offers schema-based features such as Financial Deal Management, Interaction Summaries, Compliant Data Sharing, Branch and Practice Management and Forecast Management.

FSC Service Edition is the best fit for most banking scenarios or larger firms in any vertical that want to take advantage of service oriented tools, such as Caller Identification Verification, Engagements, Timeline, Audit Trail, Action Launcher or Complaint Management.

Whether FSC Sales, FSC Service or FSC Sales & Service is selected, it is likely that your organization has custom processes that need to be configured. Rest assured the system is still customizable through configuration and so FSC can well meet many firm’s needs.

Full Customization

Another approach is 100% Custom, which is not using FSC but building all necessary functionality through custom configuration and development on top of Sales Cloud and/ or Service Cloud. This is best for clients whose data model doesn’t fit well into one of the branded vertical offerings or a combination of them, despite having a finance orientation. Multiple currencies or a need for full localization to a language other than English could also be reasons to forego FSC. Consulting an implementation partner with experience in implementing financial services requirements in Salesforce both with and without Salesforce FSC will be important for this option.

Hybrid Customization

A hybrid approach is commonly used, combining FSC with more extensive custom configuration or development. This is best when a firm has a data model that fits reasonably well into the FSC Sales Edition and wants to add additional capabilities, either because FSC Sales pricing is too high or because their business practices don’t fit well into the templated offerings in FSC Sales and they will need significant customization regardless of the edition they purchase.

In summary, Financial Services Cloud, built on the Salesforce Industries platform, can be tremendously valuable to wealth management firms, but it can also have limitations in different circumstances. It is important for financial services firms to partner with an experienced implementation partner who can help them assess their needs and achieve their desired outcomes.

If you are looking for a Salesforce Consultant to guide your team through the implementation process and deliver a custom solution for your business, contact The CRM Firm at sales@thecrmfirm.com. We are a Salesforce Partner focused on working with organizations in the financial services industry.